What’s going on in Australia? Answering your FAQs about the NEM

by RES | Juil 04, 2022 | Temps de lecture: 4 min

Recently, energy generators in the Australian National Electricity Market (NEM) faced an unprecedented event as AEMO (Australian Energy Market Operator) invoked emergency powers to suspend the NEM, which provides electricity for the most populous states in Australia (Queensland, Victoria, South Australia, Tasmania, New South Wales and the Australian Capital Territory). This extraordinary event has raised questions about the market for operators and consumers alike, and the speed of the transition to renewables is at the forefront of the conversation.

What is AEMO?

The Australian Energy Market Operator (AEMO) operates the NEM (National Electricity Market) from several 24/7 control centres in different states. AEMO works alongside the Australian Energy Market Commission (AEMC) who make the rules and regulations, and the Australian Energy Regulator (AER) who ensure that consumers are protected and that market participants comply with the rules and regulations.

It’s AEMO’s role to make sure that supply and demand is always equal to keep the lights on while ensuring the power system is stable and operating safely.

How does the market work?

Within the NEM, electricity is bought and sold in an online auction house, known as the ‘Spot Market’, with financial settlement occurring every five minutes.

The NEM is the wholesale market, where retailers purchase bulk electricity (by the megawatt hour or MWh) from generators and network services (distribution/transmission) from Network Service Providers (NSPs). Retailers package up their purchased power and network services to then on-sell to homes and businesses.

Generators are selling their electricity on the market constantly. Suppliers decide on their market offer prices the day before any given trading day, but they can adjust how much electricity they want to sell (in MW) in real time.

From here, AEMO stacks the bids from lowest to highest and dispatches the lowest offer of generation first. The market price is set by where demand sits in the bid stack and all dispatched generators receive this price.

For more information on the NEM and further explanation of the Australian energy bid stack process, click here.

What happened in the NEM?

Over the past week, wholesale prices surged, largely due to:

- the lack of availability of coal generators;

- high fuel costs (driven in part by the Russian invasion of Ukraine); and

- coal supply interruption to some generators.

This was compounded with an unseasonably high demand for energy, due to an early cold snap in North-Eastern states.

Electricity spot prices began to exceed their respective cumulative price thresholds for their regions, and AEMO began to implement administered price caps of $300/MWh (down from the normal cap of $15,100/MWh) progressively, until most regions were under AEMO Administered Pricing. Due to high fuel prices, this price cap meant that some generators would likely be operating at a loss, and it was observed that less capacity was made available in the market, particularly in states with high thermal generation such as QLD and NSW.

While the NEM Rules provide a compensation mechanism for recovering costs for generating during an administered price cap, some generators withdrew capacity from the market, as an alternative to participating in a potentially complex and drawn-out cost recovery process.

In the days that followed, AEMO was faced with several instances of ‘lack of reserve’ in several states, resulting in AEMO issuing directions to generators (up to 5GW) to enter the market to maintain stability. This became too complex for AEMO to continue to operate, while ensuring reliable supply, and the market was eventually suspended by AEMO to simplify operations.

AEMO CEO, Daniel Westerman stated:

“In the current situation suspending the market is the best way to ensure a reliable supply of electricity for Australian homes and businesses.”

As of Friday, 24 June, the suspension on the NEM has been lifted by AEMO.

Why is Australia so affected by coal and gas power stations alone? Where do renewables factor in?

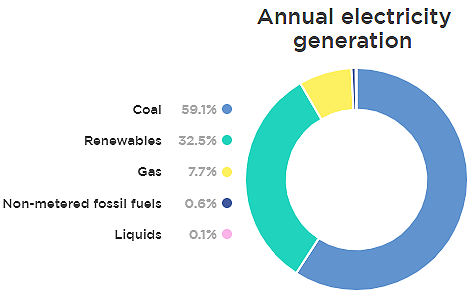

Only 32.5% of Australia’s electricity generation comes from renewables, with just under 60% of generation still coal based.

Climate change has contributed to fast growth of the Australian renewables industry, but a national approach to long-term planning for the transition to renewables has not yet been implemented.

The political landscape over the past 10 years has seen a lack of system planning from the previous Liberal Government, with no framework to consider the retirement of coal plants.

This year’s Australian Federal Election (just 4 weeks ago) has seen a change in Government. The new Federal Labor Government aims to reduce Australia’s emissions by 43% by 2030, including increasing the share of large-scale renewables to 82%, while maintaining its predecessors’ 2050 net-zero target.

“The issue here, that NSW, Victoria, Queensland and South Australia are dealing with now, has been the ideological war when it comes to climate change and energy policy in this country… What is most important now as a state and as a country is that we put the climate wars behind us, and we actually focus on the future,” Dominic Perrottet (NSW State Premier).

How can renewable asset owners manage this kind of situation in the event it reoccurs?

As always, generators must remain compliant with the market rules at all times. 24/7 human monitoring is key to ensuring your assets are compliant when extraordinary times call for extraordinary measures.

RES provides 24/7 monitoring services for 2GW of renewable energy assets around Australia.

Our 24/7 Control Centre can be engaged as a standalone service for your asset, as well as part of our comprehensive asset management contracts. With 24/7 human monitoring, RES ensures that renewable assets are not only compliant, but also performing at the highest possible levels at all times.

During the suspension period, our Control Centre continued to review settlement data and will assist in managing the recovery of opportunity costs lost via generating during administered pricing periods, as per the AEMC compensation mechanism.

The suspension of the NEM has provided yet another example of how valuable our expert operators can be when an immediate response is necessary.